DUI Convictions in The Golden State, A DUI conviction is among the most serious traffic offenses - insurance. Also if it is your first offense, you will have raised cars and truck insurance prices in addition to meeting an SR-22 insurance policy requirement to reactivate your certificate after a DUI.Car insurance policy is not the only location you need to bother with complying with a DUI conviction.

Including what is outlined in the chart below, you will certainly additionally have to pay a $125 enrollment charge and a $15 license reprinting charge after a DRUNK DRIVING (insurance group).

sr-22 driver's license division of motor vehicles underinsured deductibles

sr-22 driver's license division of motor vehicles underinsured deductibles

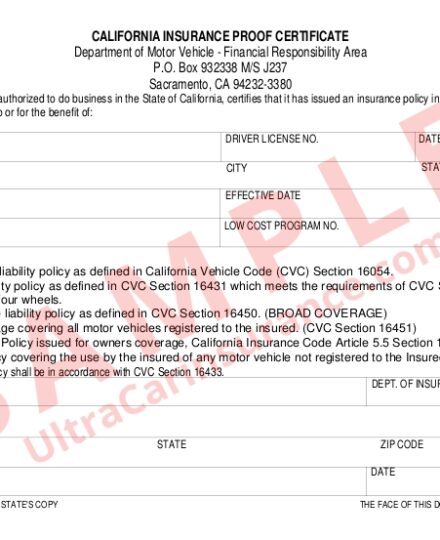

It would certainly set you back $25 to $50 for you to make a copy of your SR-22 form with your state's Department of Motor Autos. Exactly how Long Do I Have To Have Sr-22 Insurance Policy In Alabama?

When the clock has actually been reset, there is a breakdown in insurance coverage. Is Sr-22 Less Costly Than Normal Insurance? It costs concerning 3% even more per auto to have a non-owner's SR-22 coverage than to have a conventional motorist's policy; there are the high threat surcharges that insurance firms make an application for those that need an insurance plan with a security aspect of no more than 75 kg.

The original will remain valid if either the motorist's vehicle insurance coverage firm or the firm does not oppose the initial. What Happens If I Allow My Sr-22 Insurance Coverage Gap? If your SR-22 insurance coverage needs coverage and also it falls short to give it, as this have to be done, you can discover on your own fined or jailed in addition to in threat (coverage).

Some Known Factual Statements About Sr22 Insurance: What Is An Sr22? - Root Insurance

Does Insurance Drop After Sr-22? By eliminating your SR-22, you may be able to reduce your insurance policy rate; nevertheless, this doesn't constantly transform out to be real - bureau of motor vehicles. With an insurance policy that is canceled or lapsed on the day that you possess an SR-22, your insurance provider is educated to stop by the DMV to suspend your certificate.

A standard of $1,857 per year, for those who have intoxicated driving coverage, yet less than $643 without an SR-22 type, is the cost of car insurance policy coverage under federal policy. A person with SR-22 insurance policy will certainly pay $1,200 even more per year.

motor vehicle safety deductibles driver's license driver's license insurance coverage

motor vehicle safety deductibles driver's license driver's license insurance coverage

For how long Do You Have To Have Sr-22 Insurance In Alabama? It is required to have a SR-22 in Alabama within 3 years. If you don't keep at least 3 years of protection under the minimum degree, you will not have the ability to acquire anything. Is Sr-22 Needed In Alabama? If you are founded guilty of driving under the influence, or are participated in a harmful procedure, please finish an Alabama SR-22 type.

An SR-22, commonly described as SR-22 insurance policy, is a certification provided by your car insurer offering evidence that you bring the required minimum amount of automobile liability coverage for your state. coverage. If you have actually been entailed in a mishap and also were not carrying minimum automobile insurance coverage, the majority of state DMVs will require you to file an SR-22.

If a driver is needed to carry SR-22 and also he or she transfers to among these 6 states, they have to still remain to meet the demands legally mandated by their previous state. All vehicles in Washington and also Oregon need to carry a minimum liability insurance coverage. If a Washington vehicle driver has his/her certificate put on hold, the motorist should provide evidence of financial duty by filing an SR22.

Indicators on Sr-22 In California: What You Need To Know - Insurance You Need To Know

It is very recommended that the insured restore their plan at least forty-five (45) days in advance. There are two (2) means to stay clear of needing to acquire an SR-22 Washington recommendation. A motorist can make a down payment of $60,000 Get more information to the State Treasurer or obtain a guaranty bond with a guaranty company such as Vern Fonk that is certified to do service in Washington and also Oregon.

A driver can not merely reveal his insurance card as proof. The insurance policy card will certainly be required by Oregon law, to be existing in a vehicle that is operated Oregon freeways - no-fault insurance. The DMV very closely keeps an eye on compliance with SR22 needs, and if the insurance policy lapses, the insurance policy firm by legislation is needed to alert the DMV of that truth as well as the motorist's certificate will certainly be put on hold.

What is an SR-22? Frequently referred to as "SR-22 Insurance", an SR-22 is usually required for drivers that have actually had their vehicle driver's licenses put on hold because of: DRUNK DRIVING/ dui sentences Multiple website traffic offenses Driving without insurance policy License plates being ended A high number of factors on a driving record An SR-22 is a certification of economic responsibility that is submitted with the Illinois Secretary of State's office.

United Automobile Insurance Coverage offers same-day automobile insurance. The certificate informs the State of Illinois that you have obligation coverage as well as if your coverage is canceled or runs out (sr22 coverage). As this can be a confusing process, we offered some response to often asked concerns relating to SR-22 Insurance coverage. If you need a quote for your SR-22, please obtain a totally free quote.

We will make certain that you have an up to day cars and truck insurance plan to go along with the SR-22 (sr22 coverage). Sent straight to the Illinois Assistant of State workplace and can take up to 30 days to process.

Little Known Facts About How Long Do You Need An Sr-22 After A Dui? - Calle's Auto ....

You should initially buy Liability or Full Protection insurance policy and also the expense will depend on your age, driving record, kind of vehicle, and extra insurance policy variables (sr22 insurance). Be sure to call United Auto Insurance for a quote on the cheapest rate.

United Car Insurance is the cars and truck insurance firm here to help you with your car insurance coverage requires. Commitments are met, the SR-22 standing will be gotten rid of (sr22 insurance). At that time, it will certainly be essential to review your insurance policy with United Automobile Insurance as well as make sure that you continue to stay covered.

United Automobile Insurance Policy is below for you in the occasion that you require an SR-22 certificate as well as insurance coverage plan. Negative points can occur to excellent people, so we understand that having the appropriate team in your corner to assist you clear any kind of mistakes is necessary (sr22). The very best means to handle an SR-22 need is to contact us faster as opposed to later on to avoid any kind of greater risks as well as understand that you are covered.

This info is meant for educational objectives and also is not intended to change info obtained via the estimating process - sr-22. This information may change as insurance policies and protection modification.

If your SR22 vehicle insurance plan is terminated, lapses or runs out, your car insurance policy business is needed to notify the authorities in your state (credit score). (They do this by providing an SR26 form, which certifies the termination of the plan.) At that point, your certificate could be suspended once again or the state might take various other significant activities that will certainly limit your capability to drive.

What Is Sr-22 Insurance And What Does It Do? - Allstate Things To Know Before You Buy

car insurance credit score coverage coverage division of motor vehicles

car insurance credit score coverage coverage division of motor vehicles

Failure to maintain your insurance policy coverage can trigger you to shed your driving privileges once more and also your state may take other actions versus you. That's why it's so crucial to obtain trustworthy info and assistance from qualified insurance policy representatives at reliable SR22 insurance business.

And also, experienced agents will be able to aid you locate an approved inexpensive SR22 insurance coverage plan.

Below are some means that you can prevent requiring SR22 insurance coverage. Don't consume alcohol and also drive. This may appear like a simple and easy idea, yet millions of people still do it each year. Simply one beverage might place you over the legal limitation. Figure out what your alcohol restriction is according to your weight as well as make sure you remain under.

Do not drive without insurance coverage. Pay your tickets and also penalties so that your chauffeurs certificate is not revoked.

This is constantly a much better option than having your motorists certify taken away. You need to follow traffic laws and also try to drive as safely as feasible.

Some Known Factual Statements About Sr 22 Insurance : How Much Does It Cost

Constantly have you evidence of insurance policy and also vehicle enrollment available. It is unlawful to not have proof of insurance policy while driving (insurance companies). Below are the states that do not need SR22: Also if these states do not require this declaring, you should maintain SR22 insurance policy if you are relocating to a state that requires it.

There is a light at the end of the tunnel. When you make the correct selections, file for SR22 and also maintain a great driving document, you will certainly once more obtain your life back on course. The cost for this filing is typically under $50. But this is not the component that will cost you.

You will need this insurance for 3 years. Although this could cost you extra, in the end, you will certainly be pleased to recognize that your SR22 insurance policy can be gone down and you can continue on as a normal chauffeur. A DUI nevertheless does use up to 10 years to leave your record.

vehicle insurance sr-22 insurance insurance division of motor vehicles insurance

vehicle insurance sr-22 insurance insurance division of motor vehicles insurance

HOW MUCH TIME IS AN SR-22 VALID? Each state has its very own needs for the size of time that an SR-22 need to remain in place. As long as you pay the required premium as well as to maintain your plan active, the SR-22 will stay in result until the needs for your state have actually been met.

WHAT IS THE DIFFERENCE IN BETWEEN AN SR-22 AS WELL AS AN FR-44? In the states of Florida and Virginia, an FR-44 is a "Certificate of Financial Obligation". It is similar to an SR-22, but an FR-44 normally requires higher responsibility limitations. ARE THERE ANY CHARGES FOR DECLARING AN SR-22? The majority of states need a little filing cost when an SR-22 is very first filed.

All about California Sr-22 Insurance

At Safe, Vehicle, we recognize that purchasing car insurance protection can be difficult and expensive - no-fault insurance. You can call a devoted Safe, Car customer service representative at 1-800-SAFEAUTO (1-800-723-3288) to ask for an SR-22 be submitted.

After that, the SR-22 does not cost you any additional money, however, the reason for requiring an SR-22 will in a lot of instances create an increase in underlying insurance coverage prices. The typical duration of needing an SR-22 is 3 years but that differs by state. It's important to keep in mind that any type of relocating infractions while under the SR-22 declaring would likely lengthen the period for which it's called for.

On one end of the range is numerous smaller sized infractions like speeding tickets that can see an increase of around 30% while the various other extreme would certainly be a drunk-driving relevant mishap which can be closer to 135% increase. coverage. A lot of significant firms supply SR-22 plans to its drivers yet there are still a couple of that do not.